About the Program

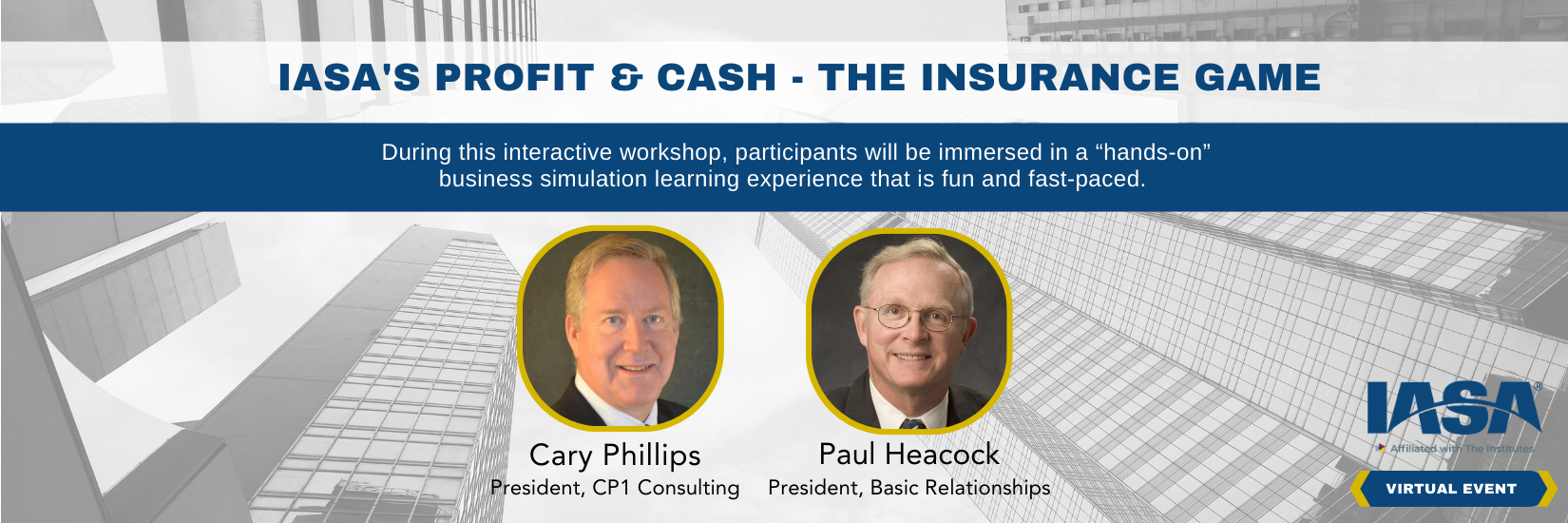

IASA’s Profit & Cash – The Insurance Game is a unique, hands-on workshop that teaches employees basic financial concepts in running an insurance company.

This fun, hands-on 4-hour virtual workshop immerses employees in the realities of how insurance works and how your company makes money and introduces the financial reporting system. It’s a great introduction to what they need to know! While participating in this simulation, you’ll get more comfortable with financial concepts that will help you understand how an insurance company operates, makes money and reports its results. You’ll become more valuable in your position by learning how various departments work together to impact cash flow and profitability.

Despite time constraints, IASA’s Profit & Cash – the Insurance Game primarily emphasizes Property & Casualty, while also highlighting crucial distinctions in Life and Health operations, profitability metrics, and reporting timelines during the simulation. This versatile tool has consistently delivered value to multi-line companies, affirming the adage, “All simulations are imperfect, but some are invaluable.”

We firmly believe that our simulation can provide significant benefits to all facets of the insurance industry. No matter your current position with the company, this workshop will take the mystery out of critical concepts and practices and make you a better professional.

Registration Rates

Click here to check for upcoming Profit & Cash workshops on the events page.

Member rate: $295

Nonmember rate: $395

Groups of three (3) or more (from the same company) will receive a 10% discount on the Member or Nonmember rates. To register as a group, please contact Gina Jolly or Tricia Stillman directly for assistance.

Learning Objectives

- Attendees will recognize how the various departments of an insurance company operate.

- Attendees will identify and better understand how an insurance company makes money.

- Attendees will learn how an insurance company reports its result

Delivery Method – Group Internet Based

Field of Study – Personal Development

Knowledge Level – Basic

Prerequisites – None

Cary Phillips is the President of CP1 Consulting, a Mission, KS-based consulting company committed to helping organizations and their employees operate more effectively.

Cary Phillips is the President of CP1 Consulting, a Mission, KS-based consulting company committed to helping organizations and their employees operate more effectively.